[Editor’s Note: The following post originally ran in Forbes magazine. It seemed fitting to run it here the first week of January when I traditionally do my Backdoor Roth IRA.]

The Taxpayer Relief Act of 1997 reestablished Individual Retirement Arrangements (IRAs) and created Roth IRAs for the first time. Due to Congressional rules, both traditional IRAs and Roth IRAs had income limits that prevented high-income professionals from deducting traditional IRA contributions, from contributing to Roth IRAs at all, and from converting traditional IRAs to Roth IRAs. The 2006 Tax Increase Prevention and Reconciliation Act included a change in just one of these rules, the prohibition on Roth IRA conversions. However, that change did not actually take effect until 2010. A few wise people quickly realized this would allow for an indirect process whereby a high-income professional could start contributing to Roth IRAs and some even began funding traditional IRAs for 2008 and 2009 in preparation of a 2010 conversion.

Personally, my income was low enough in 2008 and 2009 that I could still contribute directly to Roth IRAs for my spouse and myself, so my first “Backdoor Roth IRA” was in 2010. We have done it every year since. In January 2019, we will fund a Roth IRA for the 10th time via that same indirect or backdoor process. In celebration, I thought it would be worth stepping back for a minute and considering what has been learned from this.

How A Backdoor Roth IRA Works

Some are still not familiar with the Backdoor Roth IRA despite it being widely used now for a decade. It is basically a four-step process.

Step one is to make a contribution to a traditional IRA. If you are under 50, you can contribute $5,500 per year ($6,000 in 2019). Those over 50 can contribute $6,500 ($7,000 in 2019.) You can also contribute to a separate IRA for a non-working spouse. A high-income professional with a retirement plan available at work is not allowed to deduct this contribution.

Step two is to do a Roth conversion of the traditional IRA you just established, basically moving the money from the traditional IRA to the Roth IRA. A Roth conversion is a taxable event, but in this case, the tax cost is $0 because the basis of the traditional IRA is equal to its value. Put more simply, you don’t have to pay to convert those dollars because they have already been taxed.

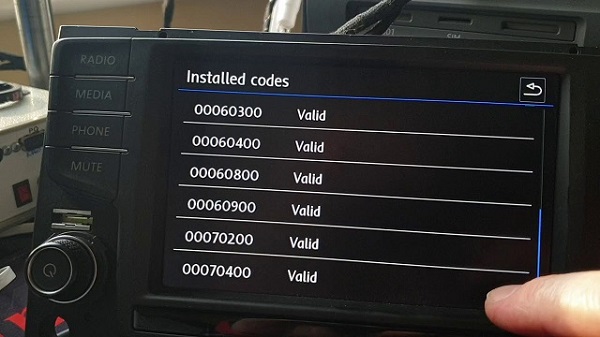

Step three is to ensure that you have no money in a traditional IRA, SEP-IRA, or SIMPLE IRA as of December 31st of the year you do the conversion. This is to prevent a “pro-rata” calculation that the IRS requires on Roth conversions. You can learn more about the calculation by looking at line 6 of IRS Form 8606. Existing tax-deferred IRAs must be either rolled into a 401(k) or also converted to a Roth IRA (which may add a significant tax bill for the year.)

Step four is to make sure the tax paperwork is filled out correctly. Both amateur and professional tax preparers frequently make errors on Form 8606 or fail to file it at all.

Tax Reduction Strategies Spread Slowly

One of the more interesting lessons we’ve learned from the Backdoor Roth IRA is just how slowly tax strategies like this spread. Bloggers, online financial forums, financial advisors, accountants, and financial journalists have been writing about this strategy for over a decade now, yet many who should be funding Roth IRAs indirectly still don’t know about the strategy.

Tax Diversification Is Useful

Another important lesson here is that tax diversification is useful. If a retiree has money in tax-deferred accounts, tax-free accounts, and non-qualified (taxable) accounts, she has a great deal of control over her tax situation in retirement. Tax-free withdrawals from a Roth IRA are particularly useful, both for the retiree and her heirs, and perhaps the best way to ensure a sizable Roth IRA in retirement is to make regular Roth IRA contributions throughout her working career and invest them aggressively.

Backdoor Roth IRAs Are A No Brainer

There are other methods of building a Roth IRA for tax-free retirement withdrawals, including contributions to Roth 401(k)s and Roth conversions of previously untaxed dollars from 401(k)s, traditional IRAs, and similar tax-deferred retirement accounts. However, both of these methods require the payment of taxes that otherwise would not be paid. Pre-paying these taxes may still be the right financial move, but in both cases, a careful calculation and evaluation of your situation should be made. In contrast, a Backdoor Roth IRA is essentially a no-brainer. Since a high earner cannot take a deduction for the traditional IRA contribution, and investing the money in a taxable account leaves the money exposed to creditors and taxes as it grows, there is no reason to avoid putting that money into a Roth IRA, via the backdoor.

No Waiting Period Required

A lot of people, including some financial professionals, were concerned for many years that the IRS might apply the “Step Doctrine” to this indirect Roth IRA contribution process. The Step Doctrine is a concept occasionally employed by the IRS that if the sum of a number of steps is illegal, the process is illegal even if each of the steps is legal. It’s easy to see why one might worry this could apply to the Backdoor Roth IRA process. Due to this fear, many advisors actually advocate waiting for some period of time (weeks, months, sometimes a year or more) between the contribution and conversion step, or worse, recommended against doing it at all. However, despite thousands of investors doing this every year (and reporting it to the IRS on Form 8606) the Step Doctrine was never applied. Finally, in 2018, the IRS issued clarification that no waiting period was required, essentially giving the Backdoor Roth IRA their blessing. Unfortunately for those who never funded their Roth IRAs or complicated their tax paperwork and ran up the tax bill on the Roth conversion step by leaving the money in the traditional IRA for lengthy periods of time, there was no going back.

[Update prior to republication: Note that since they converted their IRAs to brokerage accounts a couple of years ago, Vanguard seems to make people wait a couple of days for the contribution to “clear” before allowing the conversion.]

Congress Should Allow Everyone To Make Direct Roth IRA Contributions

It is also clear that Congress should simply eliminate the Backdoor Roth IRA process completely by allowing high earners to contribute directly to a Roth IRA. Those who know about it are doing it anyway and it is bad public policy to allow significant tax breaks only to those who are very familiar with the tax code. This is costing taxpayers additional money paid to tax preparers and financial advisors. In addition, it causes taxpayers to make decisions they otherwise would not. Self-employed individuals who wish to use a SIMPLE or a SEP-IRA for the sake of simplicity are forced to either establish a 401(k) or miss out on Roth IRA contributions. Taxpayers with existing IRAs are forced to roll that money back into a 401(k) or miss out on continuing to fund Roth IRAs. Those without an available 401(k) may end up doing Roth conversions that would otherwise be inadvisable. Congress should stop wasting our time and money and allow direct Roth IRA contributions.

Funding a Roth IRA indirectly has helped high-income investors meet their financial goals and achieve tax diversification now for a decade. It’s time for Congress to simplify the process.

What lessons have you learned from doing a Backdoor Roth IRA? Comment below!